Block Trade Vendor . — for one thing, block trades allow key clients such as private equity firms to sell sizeable stakes in companies listed on the stock market. all market participants signing block trade agreements are responsible for exercising their own independent judgment as to: As trades are settled in “t”. — block trades are transactions in which large parcels of shares in listed companies are sold off market, often following the expiry of escrow. — institutional investors often engage in block trades to efficiently buy or sell large quantities of securities without. — a block trade refers to a substantial transaction involving a large quantity of securities, typically bought or. — a block trade refers to a transaction where a substantial number of shares or other financial instruments are bought or sold at a predetermined.

from www.youtube.com

— for one thing, block trades allow key clients such as private equity firms to sell sizeable stakes in companies listed on the stock market. — block trades are transactions in which large parcels of shares in listed companies are sold off market, often following the expiry of escrow. — a block trade refers to a substantial transaction involving a large quantity of securities, typically bought or. — institutional investors often engage in block trades to efficiently buy or sell large quantities of securities without. As trades are settled in “t”. all market participants signing block trade agreements are responsible for exercising their own independent judgment as to: — a block trade refers to a transaction where a substantial number of shares or other financial instruments are bought or sold at a predetermined.

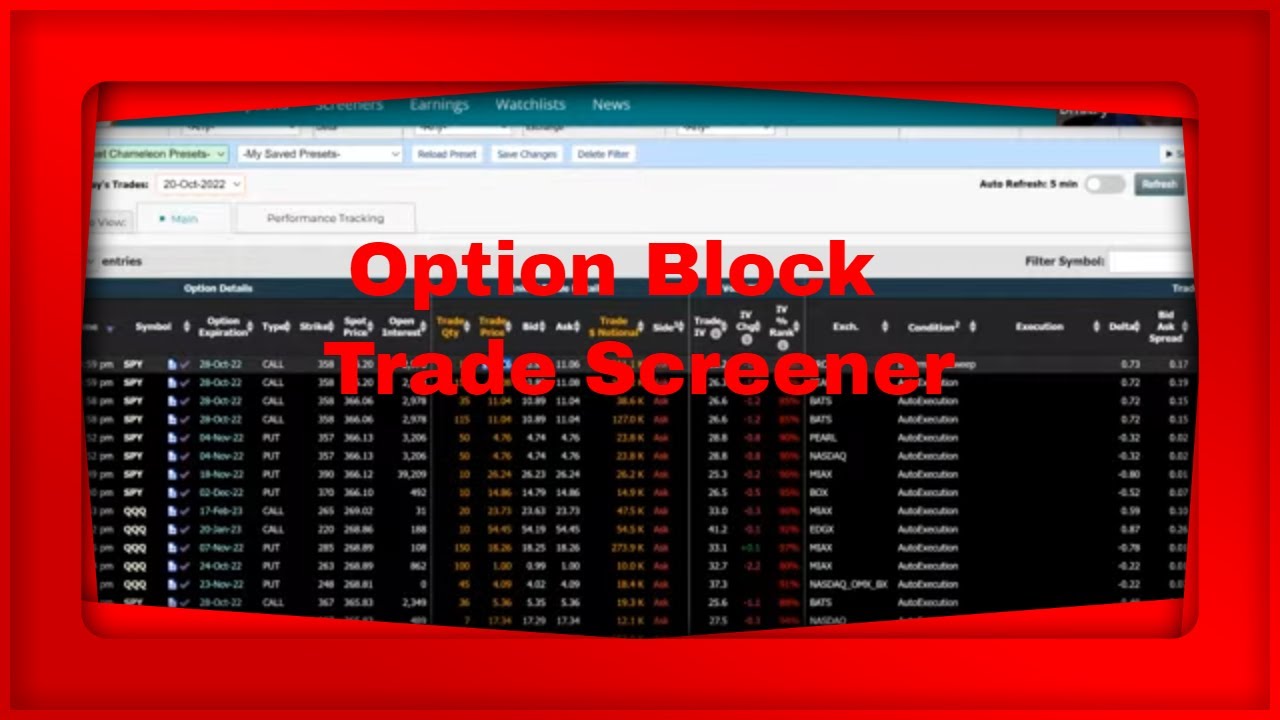

Option Block Trade Screener YouTube

Block Trade Vendor — block trades are transactions in which large parcels of shares in listed companies are sold off market, often following the expiry of escrow. — for one thing, block trades allow key clients such as private equity firms to sell sizeable stakes in companies listed on the stock market. — institutional investors often engage in block trades to efficiently buy or sell large quantities of securities without. — block trades are transactions in which large parcels of shares in listed companies are sold off market, often following the expiry of escrow. — a block trade refers to a transaction where a substantial number of shares or other financial instruments are bought or sold at a predetermined. As trades are settled in “t”. — a block trade refers to a substantial transaction involving a large quantity of securities, typically bought or. all market participants signing block trade agreements are responsible for exercising their own independent judgment as to:

From tradewithmarketmoves.com

What is block trading? A complete guide to block trade world. Trade Block Trade Vendor — for one thing, block trades allow key clients such as private equity firms to sell sizeable stakes in companies listed on the stock market. all market participants signing block trade agreements are responsible for exercising their own independent judgment as to: — a block trade refers to a substantial transaction involving a large quantity of securities,. Block Trade Vendor.

From www.awesomefintech.com

Block Trade AwesomeFinTech Blog Block Trade Vendor As trades are settled in “t”. all market participants signing block trade agreements are responsible for exercising their own independent judgment as to: — for one thing, block trades allow key clients such as private equity firms to sell sizeable stakes in companies listed on the stock market. — a block trade refers to a transaction where. Block Trade Vendor.

From www.bitflex.com

What You Need To Know About Block Trades? BITFLEX Block Trade Vendor As trades are settled in “t”. — a block trade refers to a transaction where a substantial number of shares or other financial instruments are bought or sold at a predetermined. — institutional investors often engage in block trades to efficiently buy or sell large quantities of securities without. — block trades are transactions in which large. Block Trade Vendor.

From www.youtube.com

Option Block Trade Screener YouTube Block Trade Vendor — a block trade refers to a substantial transaction involving a large quantity of securities, typically bought or. As trades are settled in “t”. — block trades are transactions in which large parcels of shares in listed companies are sold off market, often following the expiry of escrow. — institutional investors often engage in block trades to. Block Trade Vendor.

From blocktrade.com

BTEX Token Blocktrade Block Trade Vendor all market participants signing block trade agreements are responsible for exercising their own independent judgment as to: As trades are settled in “t”. — a block trade refers to a transaction where a substantial number of shares or other financial instruments are bought or sold at a predetermined. — for one thing, block trades allow key clients. Block Trade Vendor.

From tradewithmarketmoves.com

What is block trading? A complete guide to block trade world. Trade Block Trade Vendor — block trades are transactions in which large parcels of shares in listed companies are sold off market, often following the expiry of escrow. — for one thing, block trades allow key clients such as private equity firms to sell sizeable stakes in companies listed on the stock market. — institutional investors often engage in block trades. Block Trade Vendor.

From tradewithmarketmoves.com

What is block trading? A complete guide to block trade world. Trade Block Trade Vendor — block trades are transactions in which large parcels of shares in listed companies are sold off market, often following the expiry of escrow. — institutional investors often engage in block trades to efficiently buy or sell large quantities of securities without. — a block trade refers to a transaction where a substantial number of shares or. Block Trade Vendor.

From blocktrade.com

Blocktrade 2.1 is here Blocktrade Block Trade Vendor As trades are settled in “t”. all market participants signing block trade agreements are responsible for exercising their own independent judgment as to: — for one thing, block trades allow key clients such as private equity firms to sell sizeable stakes in companies listed on the stock market. — block trades are transactions in which large parcels. Block Trade Vendor.

From trading.de

Block Trading Definition & Erklärung von Block Trades Block Trade Vendor — institutional investors often engage in block trades to efficiently buy or sell large quantities of securities without. — block trades are transactions in which large parcels of shares in listed companies are sold off market, often following the expiry of escrow. — a block trade refers to a transaction where a substantial number of shares or. Block Trade Vendor.

From blocktrade.com

Tether vs. USDC A Comparison of Two Leading Stablecoins Blocktrade Block Trade Vendor — a block trade refers to a transaction where a substantial number of shares or other financial instruments are bought or sold at a predetermined. As trades are settled in “t”. — a block trade refers to a substantial transaction involving a large quantity of securities, typically bought or. — for one thing, block trades allow key. Block Trade Vendor.

From tradewithmarketmoves.com

What is block trading? A complete guide to block trade world. Trade Block Trade Vendor — institutional investors often engage in block trades to efficiently buy or sell large quantities of securities without. As trades are settled in “t”. — a block trade refers to a transaction where a substantial number of shares or other financial instruments are bought or sold at a predetermined. — block trades are transactions in which large. Block Trade Vendor.

From www.cmegroup.com

Understanding Block Trades CME Group Block Trade Vendor — block trades are transactions in which large parcels of shares in listed companies are sold off market, often following the expiry of escrow. — for one thing, block trades allow key clients such as private equity firms to sell sizeable stakes in companies listed on the stock market. — a block trade refers to a transaction. Block Trade Vendor.

From www.5paisa.com

Understanding Block Trade in Stock Market Finschool By 5paisa Block Trade Vendor — for one thing, block trades allow key clients such as private equity firms to sell sizeable stakes in companies listed on the stock market. — institutional investors often engage in block trades to efficiently buy or sell large quantities of securities without. As trades are settled in “t”. all market participants signing block trade agreements are. Block Trade Vendor.

From www.thebangkokinsight.com

มารู้จัก Block Trade กับ บล.เออีซี The Bangkok Insight Block Trade Vendor As trades are settled in “t”. — for one thing, block trades allow key clients such as private equity firms to sell sizeable stakes in companies listed on the stock market. — institutional investors often engage in block trades to efficiently buy or sell large quantities of securities without. — block trades are transactions in which large. Block Trade Vendor.

From www.th.rhbtradesmart.com

Block Trade RHB Securities Block Trade Vendor — institutional investors often engage in block trades to efficiently buy or sell large quantities of securities without. — block trades are transactions in which large parcels of shares in listed companies are sold off market, often following the expiry of escrow. — a block trade refers to a transaction where a substantial number of shares or. Block Trade Vendor.

From blocktrade.com

Introducing Blocktrade 2.0 Blocktrade Block Trade Vendor — institutional investors often engage in block trades to efficiently buy or sell large quantities of securities without. all market participants signing block trade agreements are responsible for exercising their own independent judgment as to: — block trades are transactions in which large parcels of shares in listed companies are sold off market, often following the expiry. Block Trade Vendor.

From library.tradingtechnologies.com

NFX Block Trades Blocktrader Help and Tutorials Block Trade Vendor all market participants signing block trade agreements are responsible for exercising their own independent judgment as to: — a block trade refers to a substantial transaction involving a large quantity of securities, typically bought or. As trades are settled in “t”. — institutional investors often engage in block trades to efficiently buy or sell large quantities of. Block Trade Vendor.

From www.wallstreetmojo.com

Block Trade (Definition, Examples) How Does it Work? Block Trade Vendor As trades are settled in “t”. — a block trade refers to a transaction where a substantial number of shares or other financial instruments are bought or sold at a predetermined. — a block trade refers to a substantial transaction involving a large quantity of securities, typically bought or. — block trades are transactions in which large. Block Trade Vendor.